Two New Liquidity Pools On DeFiChain

DeFiChain has announced its two new liquidity mining pools for Litecoin and Doge.

The native token called DFI from DeFiChain has been doing very well. It was traded at only $0.16 on 3 July 2020 about half a year ago. It is currently trading at the price of $2.55.

For those who are afraid of impermanent loss, they can choose to stake DFI tokens with 37% APY on Cake Defi without the need to install the software.

Staking at DeFiChain directly does give a higher APY but the need to install a software on our computer can be quite a hassle.

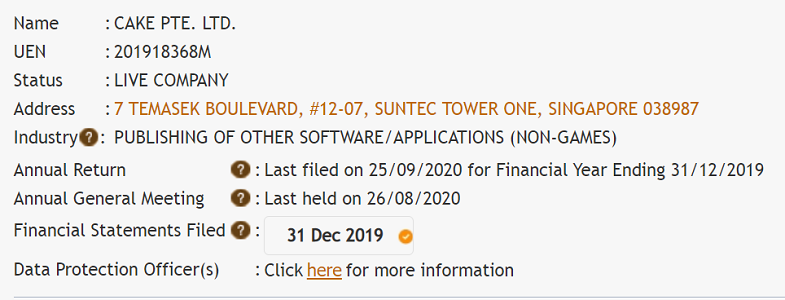

Both DeFiChain and Cake Defi are under the same founders. Both are Singapore registered companies with a physical office.

Staking BTC(5% APY), ETH(5% APY), USDT(8% APY) and DFI (37% APY) would allow a regular reward without impermanent loss.

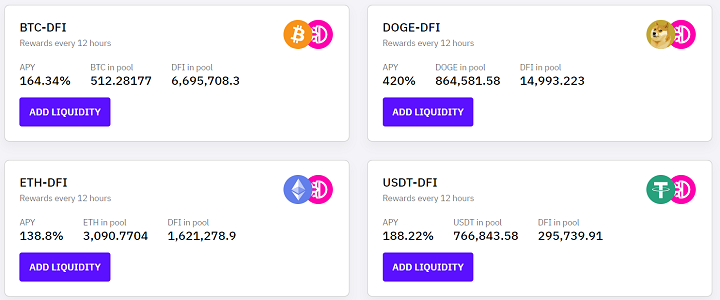

Those with a bigger appetite can try out its liquidity mining with higher reward with a certain degree of the risk of impermanent loss like most yield farming pools. Below is a screenshot taken from Cake Defi website.

DOGE-DFI liquidity pool has just been released today so the high APY would probably reduced in coming weeks.

The new Litecoin liquidity pool that is coming on 2nd Feb 2021 would probably have high APY during the starting weeks too.

Doge Liquidity Mining on DeFiChain starting on 30 Jan 2021 today.

https://defichain.ghost.io/doge-420-liquidity-mining/

Litecoin Liquidity Mining on DeFiChain starting on 2 Feb 2021 at 11:00 UTC

https://defichain.ghost.io/litecoin-liquidity-mining-on-defichain/

Previously, free $20 worth of DFI tokens was given to new member without a minimum stated but it has recently announced and changed its term to the 1st deposit must be at least $50 or more to qualify for the $20 free bonus.

Those who sign up through a referral link can still get the additional $10 worth of DFI tokens.

Referral link: https://pool.cakedefi.com/#?ref=610483

These free DFI tokens would be locked up for 180 days with staking rewards as a bait to ensure new members would have experienced Cake Defi for six months as well as to prevent abusers from selling their free reward.

Staking and unstaking of DFI tokens has no lock-up period actually. I have always stake and unstake within minutes but removing our liquidity mining may take a few hours.

As a registered Singapore company, KYC is really an important procedure to ensure the identity of those who are involved in staking or liquidity mining before one can enjoy the full feature of the service.

I have started staking since August 2020 and I have never faced problem in the service provided by them.

I had to wait for a few days for KYC verification too but the wait is really worth it especially the enormous adoption of DFI tokens.

You can find out more or join Cake Defi using my referral link below.

https://pool.cakedefi.com/#?ref=610483

Cake Defi Team is trying its best to clear the KYC as soon as possible so if you do join, you really need to be patient.

Disclaimer: This is my personal reflection and I am not in any position to instruct anyone what they should do. I am not responsible for any action taken as a result of this post. My post can only be a reference for your further research and growth. By reading this post, you acknowledge and accept that.