Cryptocurrency arbitrage trading: A ‘neglected’ billion dollar concept?

Probably you bought some crypto coins from an exchange, hoping the demand grows and as well the price. Price hike is good business!...if only you bought earlier. You could sell at a higher price and make some good gains depending on how high the price spiked.

Cryptocurrency trading just like forex and binary options could be a gold mine, but a risky one though. Nevertheless, the idea of making some good gains from the periodic and conditional variation in price of these commodities is very enticing. But getting lucky is where the bulk of the work lies. We sometime stick to popular opinions and sometimes opinions of popular traders and hope they get it right. But this doesn’t always come alive, it is ‘ninety percent luck and ten percent knowledge’ they say.

This periodic rise in price of crypto coins is unarguably the most popular concept but Price fluctuations is not only a function of time, it’s is also a function of market. Even in our everyday markets, the price of a commodity doesn’t stay same in different markets, the cryptocurrency markets aren’t different as regards this. Market-to-market price fluctuation is commonly overlooked, not just in cryptocurrency but also in mainstream trading activities.

This difference in price of a commodity in different markets is known as price arbitrage, I’m certain you’ve come across this a couple of times but ignored it…that’s normal, I’m guilty too.

What might be the cause price arbitrage?

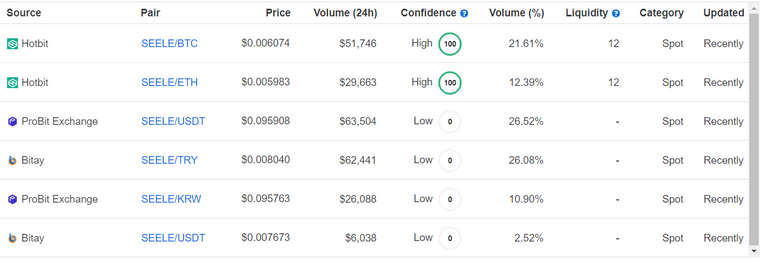

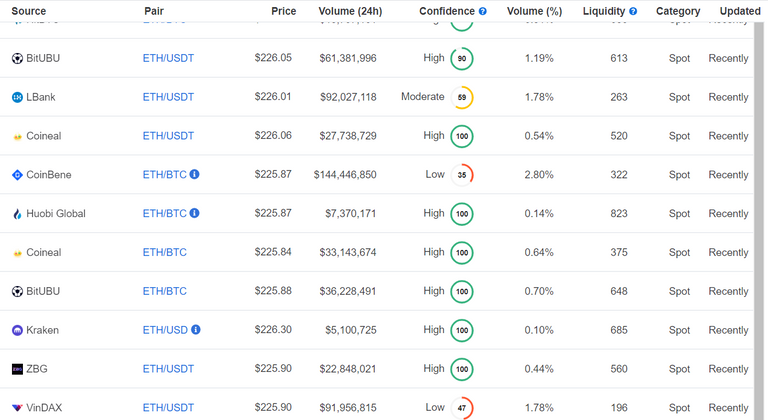

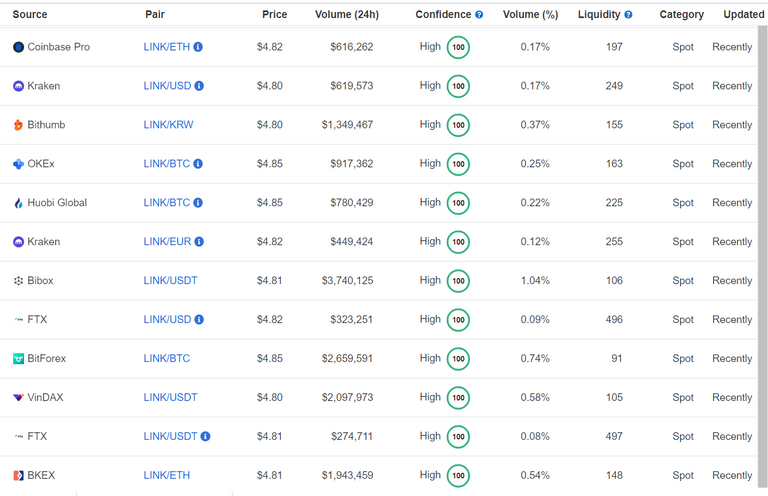

Screenshot shows varying prices of a cryptocurrency

Value is usually a product of demand…and supply. The value of a cryptocurrencies and any other community is influenced by the demand they generate, this however varies across different markets. Demand on the other hand is influenced by the utility of the cryptocurrency at a specific time, this is also subject to variations across different markets. The purchase power of a market also influences the value of cryptocurrencies on the market

For cryptocurrencies, custodian exchanges form the bulk of the trading market hence arbitrages usually occur across cryptocurrency currencies, probably there could be other forms, but price arbitrage across exchanges are more popular and our subject of focus.

In cryptocurrency terminologies, the purchase power of an exchange is determined by the wallet weight of the traders using these exchanges, the amount of ‘rich buyers’ (whales) in an exchange determines its purchase power. Whale influence drives price, more buy force from whales in market slims down the sell orders while driving the buy orders up and creating a good liquidity. When this happens at different speeds and at different times in different markets, price variation occurs. This is normal and price variation can be up to 50%.

Making profits off price arbitrage

Let me guess, you just skipped to this point, but that’s fine, I’d do the same, I mean, who has time for such long talks…lol

That was another long talk by the way. However, making profits through price difference across different cryptocurrency markets involves calculative buys and fast sells across different exchanges. Unlike the popular cryptocurrency trading, arbitrage trade requires knowledge and speed.

Keeping your eyes on the different exchanges, buying from a cheaper exchange and selling off at an exchange where the purchased cryptocurrency sells for a higher price is the mantra of cryptocurrency arbitrage trading.

Arbitrage trading is also to an extent, a game of numbers, quantity wins to an extent, net arbitrage return is obtained by deducting the exchange withdrawal charges from the gross return. Increasing purchase to compensate for trading and withdrawal charges could also be a good practice. Capitalizing on price variation is profitable practice, however, the sale and buy orders in both markets should be considered as a thin buy orders on target market could lead to substantial losses.

This post has been manually curated by @bala41288 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 80 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @joelagbo! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!