Diversifier or Maximalist: What is your portfolio game?

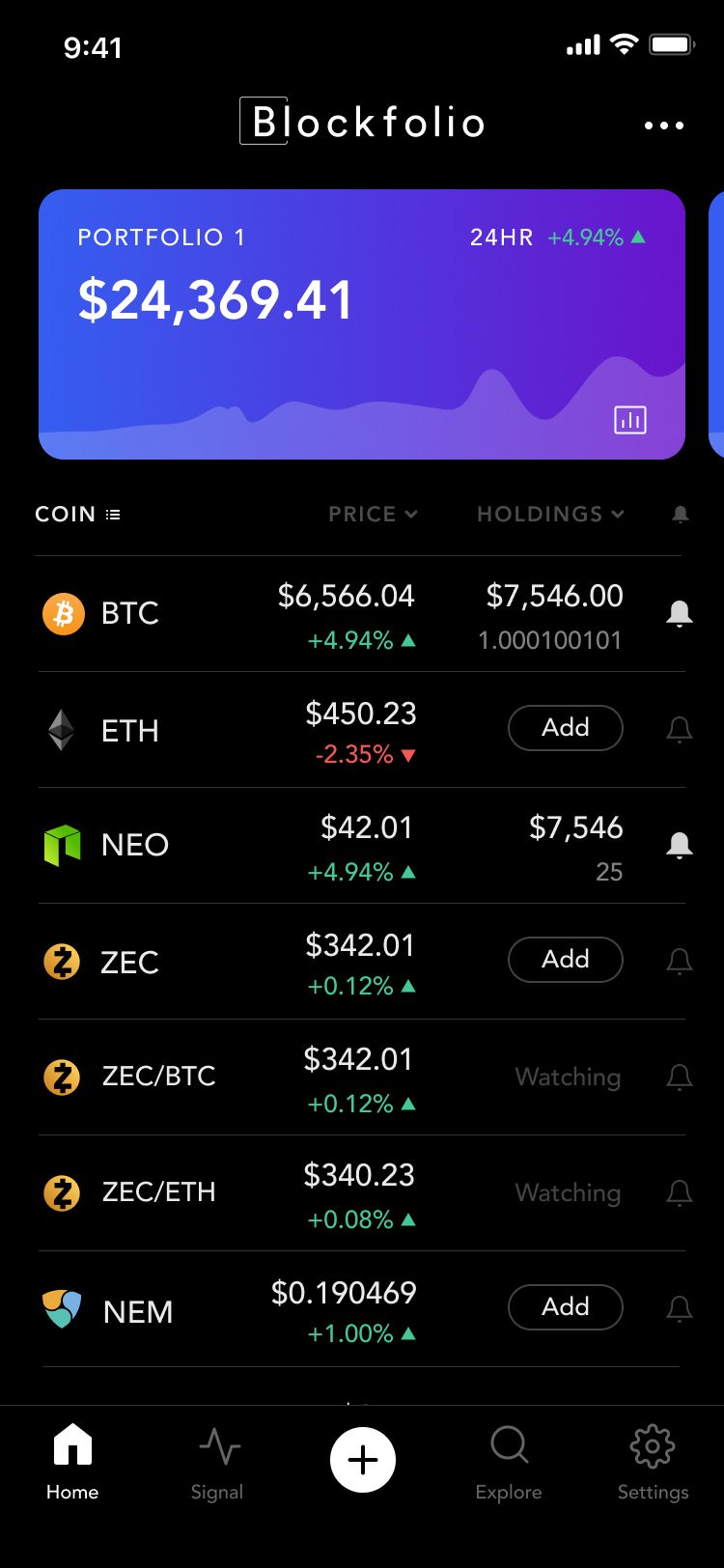

What is your cryptocurrency portfolio looking like? Oh wait; let me guess…two times actually. Majority of investors will fall amongst the first category, a tangible more will see themselves in the second category. Of course, every trader falls amongst the first category...most, to be on a more correct side.

Well, let's get to it already. The crypto space is arguably the vastest space, both in technology and digital asset market. Apart from technology and finance, sentiments also set in as a couple of project exhibits certain ethics which is welcomed by a number of people. People who gets caught in this love spell develops an unconditional love for the project in question and stick to them as a result.

Love happens many times, naturally. Whatever makes you like a cryptocurrency project can happen all over again, as many times as possible and in different ways. You’d end up investing in a couple of projects. This is you I guess – THE DIVERSIFIER!

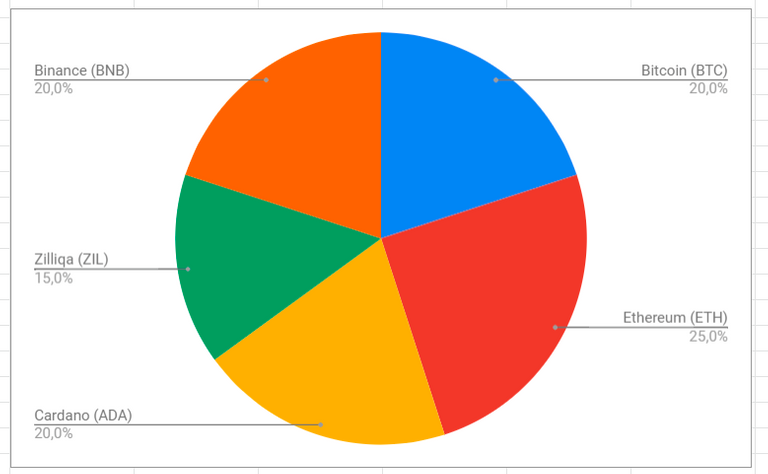

Majority of cryptocurrency investors prefer to split the funds across a couple of crypto assets. Personally, this is me too. For several reasons, a diversified portfolio is a common practice in the cryptocurrency space. Why pick one when you can actually get as many as possible? Well, this comes with its own demerits; and merits too.

Cryptocurrency is a very risky investment, thanks to it's well pronounced volatility. Values of crypto assets fluctuate over time, towards different directions. While this fluctuation is general across crypto assets; the direction of this fluctuation may differ across these assets; most times. A bad day for one project could be a good day for the other. A ‘safety-minded’ investor would spread his capital across a couple of projects and minimize his losses in situations like this. Gains made by one project might be enough to offset the losses incurred by the other project having a bad day. Things stays ‘even’, for now at least.

A number of reasons would make an investor diversify. A gamer and a believer in Artificial intelligence will probably put his money on two projects related to this, maybe some Verasity and SingularityNet tokens respectively. If you believe in crypto as a portable payment medium, you’d probably add some Pascal coin and nano to your portfolio. This may go on until as long as your cravings and sentiments last.

Apart from personal interest and minimizing risks, certain ethics held up by a project is enough to attract an investor’s attention to the extent of investing in them. Projects with a certain level of decentralization and encouragement for community involvement tend to attract a good number of investors. On the contrast; centralized projects are also attractive to some. Whatever serves your taste the most. Investors love to put their money where their mouth is. But this could happen more than once and diversification may come in as a result.

If the last two reasons explain your diversification, then price movements hardly become your focus. However, diversifying to ‘minimize risk’ works most of the times…but certainly not every time. When losses are minimized, profits are also minimized as a result, pick your poison! I guess you already did as a diversifier.

Alright, let me guess again. You are holding just one cryptocurrency asset. Uhm, you must be amongst a very little percent of cryptocurrency investors. A couple of reasons backs up maximalism. And I understand this.

The choice to stick to one project in contrast to diversification is similar to the proverbial ‘putting all eggs in one basket’. Could be a move to maximize profits, even though this could get very risky; on the brighter side, a massive success by the project you are solely invested in could blow your portfolio up with gains. The risks are high, but what on earth is not risky? There’s hardly a satisfactory answer to that rhetoric.

Apart from the decision to take the risky side and maximize profits, a very strong believe in a project's use-case, ethics and overall structure breeds maximalist views. Bitcoin and ripple probably hold the highest number of maximalists, but many other ‘good’ projects have investors who are ready to stick with only them and till the end. Tough decision I must say. Imagine how it feels to see such project record a 20% value loss in 24hrs. Cryptocurrency HODLers are arguably the most emotionally humans (lol), but this could burn hands in certain cases.

Over to you, what are you? Invested in ten projects or invested in one project only? Each with a different feeling and reason for adoption. Share our view, which one are you and why? All eyes on the comment section!

Ten is a kind of balanced spread, but you need two or three solid coins among them.

Posted Using LeoFinance Beta

I'd say 5; but depending on how vast you wish to go 10 is a good spread

This post has been manually curated by @bala41288 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 80 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.