MPATH Weekly Report and Token Distribution - over 23.0% APR - 24 January 2021 [MAP Hive FinTech]

Welcome to the MPATH Weekly Report.

This week has seen a slight drop in overall yield; the Hive blockchain yield has been stable, so this has been wholly due to a slight dip in income.

However, even our net estimate of over 23% APR shows we remain significantly higher than the 15% yield the chain produces for the average user with under 100k HP. Also a reminder that gross income is distributed across both the distributed tokens and the increase in official token price; our NAV remains about 5% higher than the ABV as insurance against any negative effects.

You will see that we are back to paying distributions in MPATH tokens. The other small effect on our yield is that it takes two weeks for new token sales, and hence power-ups, to fully integrate their income into the whole fund.

The issue at the moment, as mentioned last week, is that our voters do not seem to be responding. Indeed, this is one reason our income distribution had risen in recent weeks. However, this isn't how MPATH should work, so we are trying to fix this as soon as possible. In the meantime, we have temporary voters working, but they need to be updated manually.

So if you have bought some MPATH tokens and don't see your vote weight increasing, then please just leave a comment and I will check. The weights are also truncated integers, so 1% extra is equivalent to 20 MPATH tokens.

Our buyback MPATH token price will continue to rise in line with the whole fund's asset value, but as the increments are in 0.001 HIVE weekly price changes may vary so as to keep pace with the NAV. The capital base remains healthy and other sources of income, such as DCity and DHEDGE, continue to perform well so that we are not wholly reliant on the voting-economy. We have started increasing the sale price above the original 0.60 HIVE; this will be slower than the buyback price until we reach a spread of about 0.03 HIVE, at which point they will rise in unison.

I also see users buying and selling in the current large spread between our official buy and sale prices. That's all fine and the reason we have a market.

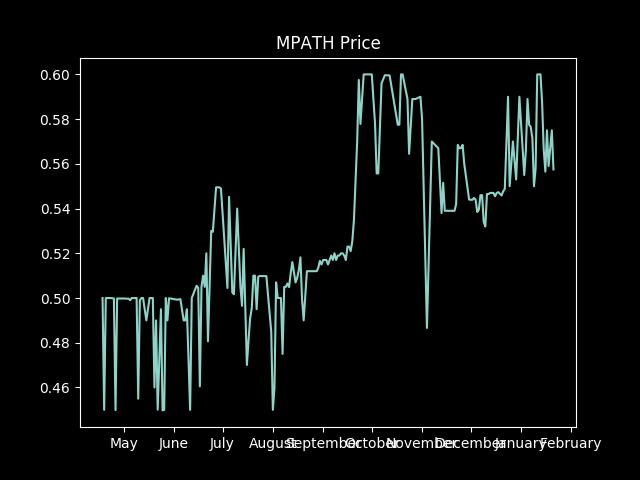

Here is a graph of the MPATH token price. (Thanks to @gerber for the discord-bot.)

As you can see, it is a rather jagged affair, mainly because the spread remains wide so those spikes are merely the difference between someone buying tokens and someone selling them.

And on to my usual closing remarks...

As ever, I give the caveat that individual member returns depend on many things, but these are our baseline figures to see how income changes from week to week. This is also a good time to remind members that such high returns may require adjustments at times so that our Voting Power does not get too low. We have plenty of capacity left, so this is not an issue, as yet, but members with 2000 MPATH tokens are getting votes from about 35k HP, so even if the VP is down to 60% that's still an effective vote from a 21k HP account.

A final reminder that the maximum holding to receive votes is 2000 MPATH, and the maximum to receive reward distributions is 5000 MPATH. You may, of course, own more than this as an investment. We shall increase these if we see the demand to do so, but they are there to attenuate the effects of large accounts and thereby help the smaller accounts. Also worth a reminder that any accounts below 10 MPATH will receive no benefits.

For full details, please read How the MPATH Program Works [May 2020].

Have a good week!

The MPATH headline figures are:

MPATH tokens active = 42,850

Earning HP = 42,460

Voting HP = 38,370

HP in MPATH = 21,930

Other HIVE = 3,310

Total HIVE = 25,240

MPATH ABV = 0.562 HIVE (+0.002, +20.4% APY)

Sale Price = 0.605 HIVE

Estimated Gross Earnings = 7.35 HIVE per 1000 MPATH = 38.2% APR

(7.35 = 1.78 income + 5.57 votes)

Estimated Net Earnings = 4.78 HIVE per 1000 MPATH = 23.7% APR

(4.56 = 1.78 income + 2.78 votes)

Total MPATH Distribution = 86.0 HIVE = 142 MPATH tokens at 0.604 HIVE sale price

Hive est. APR = 15.1%

Note that "Other HIVE" is the sum of all holdings not powered up as HP: liquid HIVE and HBD plus holdings within Hive-Engine. Also note that such values are volatile, especially any holdings priced in US$, so the above numbers are a snapshot and may have changed when you look at the @MPATH account.

The Asset Backed Value (ABV) is our total holdings calculated in HIVE divided by the number of active MPATH tokens.

Any questions, please ask in the comments below or in our public chatroom.

[BUY MPATH] - [READ MPATH]

[BUY new M token] - [READ M posts]

Very good news that it is going up, it looks very promising.Your reports are always very useful, thank you for your contribution

Many thanks for your comment - often hard to know if anybody actually reads these posts!

Yes, of reports to keep us informed, because many times we find very interesting things

Your post has been voted as a part of Encouragement program. Keep up the good work!

Try https://ecency.com and Earn Points in every action (being online, posting, commenting, reblog, vote and more).

Boost your earnings, double reward, double fun! 😉

Support Ecency, in our mission:

Ecency: https://ecency.com/proposals/141

Hivesigner: Vote for Proposal