Statera – DeFi 2.0

In 2019, the first self-destructing cryptocurrency was launched. It was called ‘BOMB’. BOMB was a simple deflationary cryptocurrency. The project received polarizing feedback from the crypto community. They wanted to address ‘token velocity’ of the tokens in the decentralized world. Token velocity is the speed of release of new tokens in the ecosystem. BOMB was a social experiment but it made people interested in the tokenomics of deflationary cryptocurrency. BOMB also demonstrated that there was a market for decentralized hedging against inflationary instruments. Statera project started just like BOMB in an ordinary manner but later they came up with a more experimental and dynamic concept.

“If you want something new, you have to stop doing something old.” – Peter F. Drucker

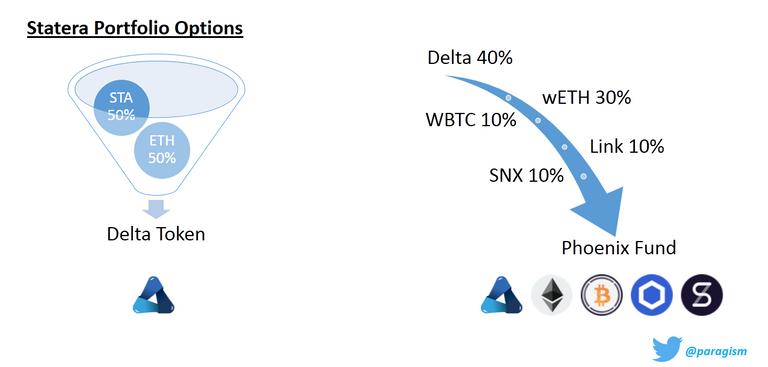

Statera innovation - Deflationary Index Fund

This crypto space is often complicated for the newbies now. Traditional finance has merged with the decentralization of cryptocurrency to form a new domain – Decentralized Finance or DeFi. The traditional financial concepts are always relevant. Today all these concepts are getting new lease of life in DeFi. An index fund is a type of mutual fund or exchange-traded fund (ETF) which has a pre-constructed portfolio to track the components of a market index. A market index can be S&P 500 or NYSE Composite Index. Statera project’s native token is also called Statera (STA). It is a smart contract powered Indexed token in automated Balancer Pool. The token works with a community-driven trustless portfolio of crypto assets. The portfolio includes Wrapped Bitcoin (WBTC), Wrapped Ethereum (wETH), Chainlink (LINK), Synthetix (SNX), and Delta (50/50 ETH/STA). Different assets have different weights in this portfolio - Delta (40%), wETH (30%), WBTC (10%), SNX (10%), LINK (10%). Obviously you can see that high weights are given on Ethereum.

The name ‘Statera’ is derived from the Latin word for ‘Balance’. Statera’s Index Fund is a hybrid of a liquidity pool and an index fund. The smart contract is programmed to function in an intuitive manner to balance the portfolio. Sounds awkward? The financial robot manages everything for you. Statera is deflationary. On every Statera transaction, 1% of the value of the transaction is burned. When the price of an asset increases within the portfolio, the robot sells the appreciated asset and rebalances the portfolio. Yes, that’s how ‘Balancer Protocol’ works by using Smart Order Routing (SOR) and makes an automated market. If STA price drops, Delta is sold for other assets and vice versa. Delta token price fluctuation creates constant arbitrage opportunity and portfolio rebalancing. Every time the portfolio rebalances, Delta token volume changes. Delta consists of 50% STA. Every STA transaction causes deflation of STA. Deflation means reduced supply. When supply becomes less, demand increases. Increased demand for STA adds more trading volume of STA. More trading volume of STA leads to more burning. So STA gets the huge scope of price appreciation. The portfolio also provides you with liquidity and collects trading fees for you. More trade volume means more fees. Self-sustainable automated portfolio management helps you to gain profit constantly. Yes, that is the concept of Indexed Deflationary Token (IDT). It mitigates your sector exposure risk and drives portfolio gain.

Statera – an imaginary use case

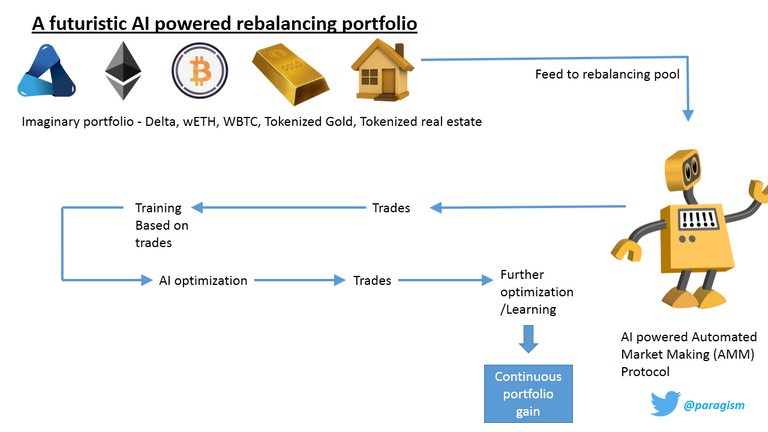

Right now, Statera is using Balancer Pool automated market-making (AMM) system. But Statera can be used in different kinds of portfolios with different types of market-making protocols. As it is an ERC20 token, obviously the portfolio management needs to happen on the Ethereum blockchain. Bitcoin has already arrived on Ethereum as WBTC. Litecoin has also arrived on Ethereum as an Ethereum wrapped token a few days back. Ethereum can tokenize any kind of asset and Statera can balance any kind of portfolio. Imagine a portfolio of tokenized gold, real estate, Bitcoin and Ethereum. Your portfolio manager Statera will deploy the bots to manage it for automated daily return for you. Statera envisions to put ‘cryptocurrency in every portfolio’. Statera can invite more people to experience decentralized finance while maintaining their privacy, security and providing autonomy. What if they use AI? I’ll like to see them implementing machine learning bots which get trained along with the trades and increases the efficiency of trading towards generating more profit. That future is not far away.

”The early bird catches the worm” – old proverb

If you want to invest in Statera’s Deflationary Index Fund, check this detailed medium post by the team. The process is very properly explained there. So far, they are able to generate a net return of 15-20% per month for the holders. J.M Barrie’s Peter Pan spent his never-ending childhood on Neverland as the leader of the lost boys but DeFi is not a ‘La La Land’. DeFi is real, dynamic and the protocols are ever-changing. We need to experiment with new ideas. A deflationary token inside a rebalancing pool is a bold idea. BOMB only tried to address the ‘token velocity’ problem. Statera comes with the practical application of deflationary index funds in DeFi. If you want to grow your Ethereum holdings over a period of time, give Statera a try before the return of the Ethereum bull.

Cheers!

[paragism]

Note: The images (if not cited) are created by the author using free vectors.

So I have a question! Is this statera doing the work or balancer that is actually doing the job? It feels to me like sta is just like everything else on balancer?

It is Balancer which does everything. :) Statera provides deflation in the particular pool and that makes the pool unique.

Safe deflation. I think that's worth mentioning because defaltionary tokens can be abused really heard in Balancer. After the hit in June, Statera transitioned to the Delta token which allegedly is a safe way of introducing deflation in the Balancer pools.

My point is, we shouldn't advise people to put their money in Balancer pools with defaltionary tokens wince other projects may not be as willing to refund people's money like Statera was.

I know you didn't encourage that, but I think we should always use the terms Statera and Delta Token accordingly so that people don't just go invest their money into Balancer pools with deflationary tokens thinking that this is what Statera's doing anyway.

Posted using Dapplr

That’s the thing. Statera is saying like they are equal or equilibrium or whatever but actually balancer is doing the work. And they are saying like get the delta token and put that into balancer is like... what is statera actually doing. I was confused 😔

I guess the only merit is the ideea and the implementation of the defaltionary thing. They're also providing support, pretty great from what I've heard

Posted using Dapplr

I think the idea is great. It sounds very promising. Does delta token actually earn you money?! How is it doing 🤔

So, according to the image on my Publish0x I have invested 158.838 STA and 0.0258 ETH in the pool. Right now I have 159.436 STA and 0.260 ETH.

So, not accounting for changes in the market price, I have invested $20.8 and now I have $20.94 => $0.14 profit

Posted using Dapplr

That is not too bad I guess? Plus you will get $30 DAI from the contest 😉

How do you know that? It was supposed to be secret 😳🧐

Posted using Dapplr

Its obvious read all the other posts. Most of them are like half ass what is statera? kind of thing that is like straight out of their homepage 🙊 🙉 🙈

Whooo that's harsh 😂😂😂. 🙀🙀🙀🙀

Thank you for the honest input. There a couple of good posts though, mine included. I think mine's the most casual, maybe that's why so many people liked it 😄

Posted using Dapplr

Yes when I read a post I want some 🤯 🤯 🤯 factor. You got one I think few other post got one. a lot of them... nothing 🤣

Tomoyan dropping the bombs right here 😂😂😂

Posted using Dapplr

Oh no... I didn't say like a mean way... I tipped them for their effort.

but I was just being honest 😆

I know, I know. They are truth bombs 😂

Posted using Dapplr

Btw you should check your Brave GitHub rewards, I think Santa Clause might have left something for you there 😂😅

Posted using Dapplr

Really? Let me check 🤩

OMG 10 BAT? is that you?

Nooo, it's Santa 😂😅

Posted using Dapplr

I thought santa was my mom 😝

Santa's real. Since he only works one night a year, he spends all the other days crypto-trading and using Brave. 😂

Posted using Dapplr

love it 😍

🤩😁 should I bring it here? What do you think?

Posted using Dapplr

I liked this one 💪

The Balancer hack happened due to the loopholes in Balancer Protocol. I think Balancer refunded all investors as the pool was whitelisted then. Obviously, such things are extremely risky.

Yup it was Balancer's fault, their exchange code was faulty, but Statera team was the one that made the refund as far as I can tell

Posted using Dapplr

Ok...I am not sure.

This post has been manually curated by @bala41288 from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 80 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @paragism! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

Hello friend, an interesting proposal, great article thanks for the information.

Thanks for liking it