Bitcion and gold might recover at first

In the previous few weeks, we’ve been witnesses of drastically dump of the stock market followed by the price drop of Bitcoin and crypto. The reason was panic from the potential harm of new virus Covid-19 and its impact on the world’s economic conditions.

As the price seems to stabilize in some way and governments are calming down the crowds by unlimited packages of free money, let us start thinking of what will happen next.

Bitcoin and gold as the answer

I think Bitcoin's price can rebound at first along with precious metals such as gold and silver.

Traditional financial markets are in big trouble at this moment and if Bitcoin will act as a safe haven as gold is for thousands of years, that would accelerate its movement.

Traditional investors might realize, that Bitcoin is not positively correlated to the traditional financial markets and start moving their Investments into the crypto. And Bitcoin is the first logical step. It has the most liquid market from all cryptos and other cryptos still are ruled by the price of Bitcoin.

The halvening, which will occur in May, looked like a typical fundament just a couple of months ago to me. Like the halvening of Litecoin, the price could move a bit up and then down just before the halvening. But then the Covid-19 pandemic happened and Bitcoin fell with its price as the financial markets did. But $ 4 000 seems to me like the confirmed bottom of $ 3 000.

Another reason which makes me feel bullish is Tether printing. The quantity of minted Tether increased by 1/3 just a few days ago! And it was always a bullish sign in the past.

All these indices make me feel, that owning Bitcoin, Gold, and Silver might be a good thing in the next few months and years. As Robert Kiyosaki, the famous author of Rich Dad Poor Dad's bestseller said, Gold is god’s money and Bitcoin is people’s money.

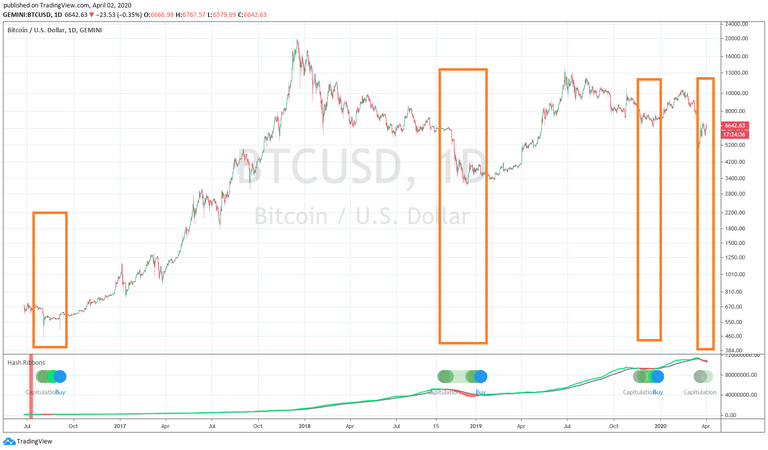

Miners capitulation to consider

One more thing is necessary to consider. Miners capitulation. This event was in the past really great opportunity to purchase Bitcoin. Not to sell it, to buy it! And when the miners are capitulating, the price is very close to its bottom. Just look at this BTC/USD 1D chart with the Hash Ribbons indicator, which shows us the moments of miners’ capitulation as the moments to step into the market with your fiat. And the buy signal of Hash Ribbons will come right in a few moments I would say. You can wait for it or start accumulating now with a dollar-cost-averaging strategy (DCA).

The Hash Ribbons indicator

Conclusion

The pandemic is definitely not a good thing in the lives of many. In a healthy and also an economic point of view. But sooner or later, we will get through this period. Hopefully, it will not make that much damage as it has the potential to do so. But experienced investors can do the right steps even when the market is crashing because they find its potential and value.

As governments are throwing money from their helicopters, investors might still feel worried about the future downfall of the stock market. History told us, that it can still happen.

In my opinion, the first assets which will recover will be Bitcoin and cryptocurrencies followed by precious metals such as gold and silver. Those assets are not correlating to the traditional financial markets so they will prove once again and not for the last time, that they might serve as a safe haven in the potential of hyperinflation, which I don’t say its around the corner, but investors need to take it to consider.

Do I expect the bull market this year? I don’t think so, the price may recover to 10k and even higher, but "the ride” will come in my opinion in the upcoming year after the halvening event.

@tipu curate

Upvoted 👌 (Mana: 3/28)

Dear @ritxi

The way I see it, recent dump has been caused mostly because of credit crunch that is happening now. Businesses and individuals need to pay their taxes, but also loans and morgages. And all those loans are being paid in FIAT currency. So demand for FIAT has been increasing since more and more people out there are losing their jobs and more businesses are struggling.

From business point of view - I would always focus on securing my most important assets. And gold/bitcoin at the moment wouldn't be in that category. My house and my business would be.

There has been huge amount of cheap money pumped into economies. I would expect that once economies will start recovering and virus will become thing of the past - then we will experience huge wealth movement from FIAT towards any sort of assets (including bitcoin).

Wouldn't you agree?

ps. apparently it's hardly possible to purchase any real gold at this moment. Most miners are closed down and there is literally no gold on the market.

solid read, Upvoted already

Yours, Piotr

@crypto.piotr, thanx for your relevant thoughts. I agree with you, yes there is a need for FIAT and continuous work on one´s business, indeed. But those who don't struggle (smart money, higher class etc.) will realize earlier or later, that the moment of grabbing an opportunity has come and I think BTC and gold (physical better, but virtual will do also) will be the first who recover.

I am sure that thinking about investments for someone who was hit by the crash is not relevant and should not be. But when those people get over the worst moments, gold (and BTC) as a store of value preserving from inflation might be the one which will be put at the first line of an investment decision.

Thanx for stopping by

I am pretty bullish about Bitcoin and Gold as well. I have wrote down my thoughts in one of my earlier posts.

Hi @culgin, I will take a look at it, thanx.