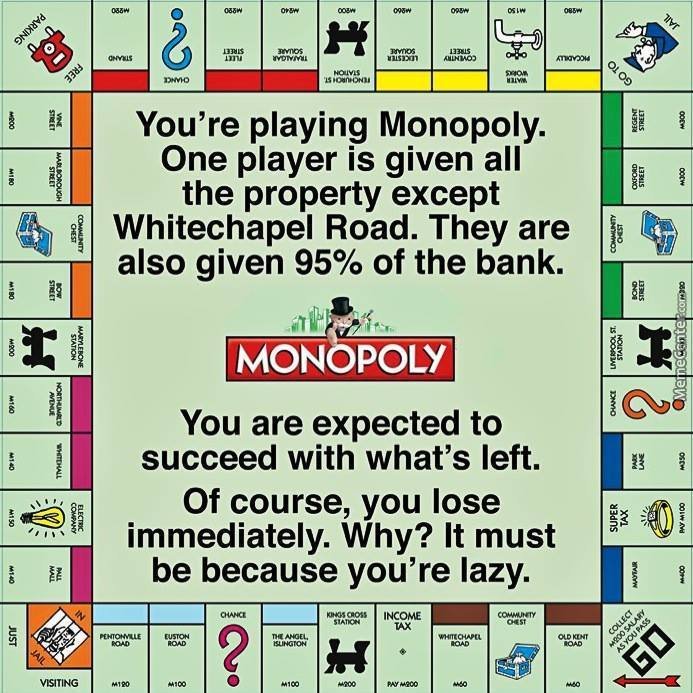

The truth about Banking

5 years ago I shared this quote and its so good I would like to share it here for your consideration.

This is how we are being ROBBED by banks exactly. They are using phony money to buy up promissory notes. promissory notes account for 97% of the money supply. It does not matter who you vote for because those that can con you will control one of the the most important part of your life, which is money.

This is a lecture from economist Richard Werner about banking:

"I will tell you key points about banks. In case you thought banks lend money, they take deposits and lend money. You are wrong . Banking was developed, modern banking was developed, in the United Kingdom in the 17th century and the legal facts are very clear but not very well known. Banks do not take deposits and banks do not lend money. That's a fact.

How is that possible. How is that possible. Well, legally they do not take deposits. They borrow from the public, because your money at the bank is not on deposit. Its not held in custody, it's not a bailment.

What is it legally? You have lent money to the bank. So the expression in banking are designed to mislead what's really happening. Who is the owner of this money? It is the banks, you are just a general creditor. Which is very different from the impression given when we use the term deposit.

What about lending surely banks lend money? No they don’t. No bank has ever lent any money. How is that possible? What does a bank do?

Banks purchase securities and they don’t pay up. That's what they do. How is that? Well if you go to the bank and you borrow money you sign a loan contract. Very crucial. Your signature creates the money supply.

Because the bank legally will consider the loan contract a promissory note. And that is what is considered legally, is a promissory note. Just like the bank of England Note, central bank money, paper money, is a promissory note from the central bank. And the bank purchases this contract. That is what they do, they purchase the loan contract.

Now they owe you money. You say I dont care about the mechanics, give me the money. The banker will say we will put it in your account. You will find it in your bank account. Well what is a bank account? It is not a deposit. Its a record of the bank's debt to the public. It is a record of the bank's debt to the new borrower, and they show you the record of how much money they owe you. That is it, they don’t pay up. And this is how the money supply is created.

So lets go in sequence:

Step one: You go to the bank and you sign the loan contract, say a thousand pounds. This will be recorded in the bank balance sheet as an increase in bank assets. The bank, will then, record its debt to the borrower. But it will do some accountant trick. It should really say this is an accounts payable item. Something that the bank has to pay but it has not yet paid. But it wont record as an accounts payable.

If you talk to an bank's accountant they are horrified “No you cannot use an expression like accounts payable in a bank” And do you know why? Because they recorded it as customer deposit. They show it on the bank's liability side as a customer deposit. But nobody has deposited it, the customer has not deposited for sure. The customer is borrowing it. The bank has not deposited either. It is added to the money supply, and this is how 97% of the money supply is created out of nothing on the basis of a signature and of course on the credit of the borrower. That is money creation. So no money is transferred from any where else to the borrowers account."

Is this true?

Can this be verified? Is there a better way? Most of our lives we assume money comes from the bank. And that they have our money in a n vault somewhere. I haven't received much input on this over the past half decade but I think it is worth revisiting.

Making a penny on the dollar to mint dollars lol right.... this system is going to last...