COVID-19's incubation period also applies to the stock markets

Hi everyone, it has been a while since my last post. I was away on a week-long business trip in Jakarta and did not have the chance to post anything. Due to the COVID-19 outbreak, the trip was rather uneasy for me but my travel experience will be for a future post.

While I was away from Steem, it has been an interesting week. About a month ago, when the COVID-19 virus was spreading in China and Asia (even before it was even named COVID-19), I wrote this post on how it can potentially affect the stock market. I talked about the impact of the virus being underestimated and stock markets should be taking a more than 10% drawdown based on past pandemic situations.

It seems after a month of "incubation period" the stock markets are finally showing some "symptoms". From the highest price point on 19th Feb, to the lowest point yesterday, there is a 15.7% drawdown for SPY (ETF tracking the S&P 500).

Slicing through near-term meaningful supports

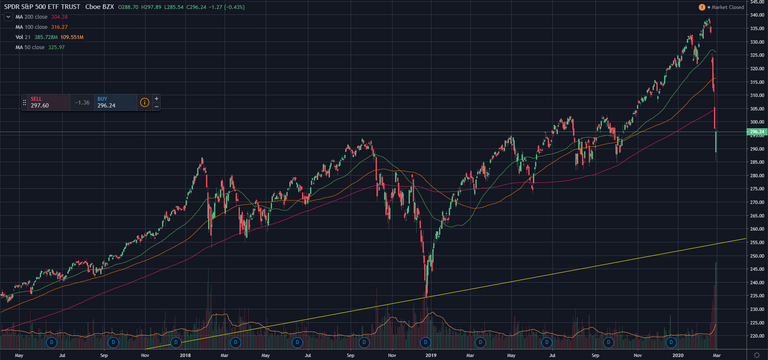

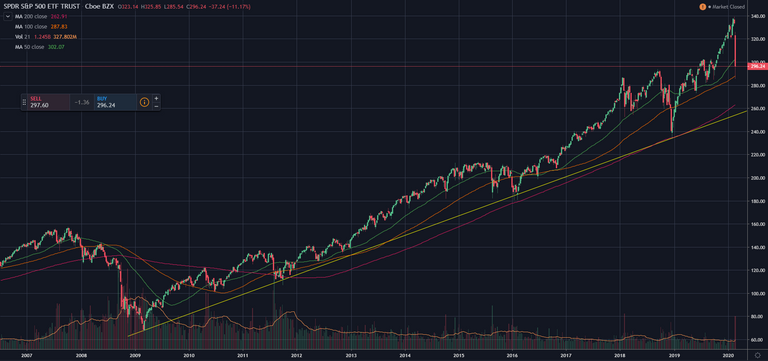

The next question will naturally be, "how low can it go?". On the daily chart, the price action has sliced through the 50d (green curve), 100d (orange curve) and 200d (red curve) moving averages.

Looking at the weekly chart, the price bounced off the 100w (orange curve) moving average last night at about 288. Which is a good sign and it probably mean that is a possible support. It is also interesting to note that this is also a 76.4% Fibonacci retracement level on a monthly chart since June 2019. Hence, I think the 288 level will serve as an important support next week.

If the 288 level does not hold, I think we will be testing the 200w moving average of around 263. Notice that the 263 level is also near the long-term trend line (in yellow) that stretches to the great financial crisis in 2008/09.

Feds jumping into action

Given how fast and furious this sell-off is, it is unsurprising that the Federal Reserves will jump into action. In fact, they have made an announcement yesterday that they "will use our tools and act as appropriate to support the economy". This means that many investors will be expecting a rate cut from the 17-18 March FOMC. Depending on the situation, the Feds may even hold the meeting earlier.

Conclusion

Given that the Feds still have room to cut rates, I think the sell-off will be temporary. However, there is still a chance for SPY to hit the lower support of 263 level given how fast and furious the sell-off is. If you noticed from the charts, the 200w moving average was tested during the December 2018 sell-off. We might see a similar pattern in which there is a bounce from this level, then a further sell-off to the 200w moving average.

The next couple of weeks leading into the March FOMC will give us more clues on how the market will respond. In the meantime, I will just be sitting on the sidelines and doing more research. I am looking at a few individual stocks that are oversold and will emerge strongly after this sell-off.

All these being said, it is not financial advice and please do your own due diligence since you are investing your own money :)

Personal disclosure that I sold a 305/294 bear spread last month and am now taking some profits.

10% of post rewards goes to @ph-fund, 5% goes to @steemworld.org and 5% goes to @leo.voter to support these amazing projects.

Join the Steem ENS Discord server to interact with the community!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

Hello @culgin

Thank you for followed @haccolong account. As a thanks, this post has been randomly selected and upvoted by @hoaithu's Curation Trail !.

To earn more rewards with your Steemit account. Check through some of the ways at this post.

I will continue with random upvotes in the future &wish you lots of luck :)

Yeah black swan spreads those wings at the same time the plauge is here.

It's bad. No joke. And shows why your sourcing can't totally rely on Chinese manufacturing.

Time to bring those jobs back home to the local people.

Europe is already screaming. USA is pinched as most health care supplies needed are one use and from China.

Just imagine the healthcare bill over this. Time for that health care reform. The nation is going to be crushed.

China might get off lucky. If they get through the flu first? Then while we are down. Easy win.

Crazy. New world.

Posted via neoxian.city | The City of Neoxian

Very well said @ganjafarmer. Black swan is spreading it's wings and it's already clear that very difficult and challenging times are ahead of us :(

Local people will not be interested with most of those manufacturing jobs. That's the problem. People living in developed countries do not like to work like ants and being paid pennies.

If we would bring those factories to our countries - then price of final goods would double or tripple. Simple as that.

Easiest way for us to get around all that manufacturing is to invest heavily in 3D printing as well as open up the market for more CNC machines.

start manufacturing our own products using the same process that the Chinese people do to alleviate the labor.

One worker can do 20 times the work with an entire shop of CNC and 3D printing machines.

Bring down costs absolutely it will and it will also empower local industries to source all the manufacturing in house

Posted via neoxian.city | The City of Neoxian

It's me again @ganjafarmer

I would need to ask you for little favour. Recently I've decided to join small contest called "Community of the week" and I desribed our project.hope hive/community. Would you mind helping me out and RESTEEM this post - just to get some extra exposure? Your valuable comment would be also appreciated.

Link to my post: on steemit or on steempeak

Thanks :)

Yours, Piotr

I was shocked at the number of points that the DOW had dropped. The last financial crisis happened 12 years ago. I believe the next one is around the corner. But we will see what happens. Looking forward to your travel post! Upvoted!

It is indeed shocking @afiqsejuk

"Interesting" times ahead of us.

I am also surprised by the magnitude and the speed of the sell-off. The next couple of weeks will be even more interesting

Dear @culgin

Interesting choice of topics. I like how you put it in words, that incubation period also applies to the stock markets.

The truth is that if US wouldn't pumpt so much money into REPO market (those money ended up greately on stock market) then we would witness panic sell much earlier. I'm not sure if seeking levels of supports make any sense any more. How can TA be useful when we deal with central banks manipulating entire stock market and growing panic being spread like a wildfire.

ps. hope you trip to Jakarta was succesful. Apparently it's an awful and ugly city. Very different from singapore. Was it also your impression?

Upvote on the way :) Enjoy your weekend buddy,

Yours, Piotr

Indeed. There has been a lot of money printing that continues to support the stock markets. I think TA still makes some sense as long as the world still believe in the current fiat system. Remember that the Feds can still continue to print money and reduce rates. The US market is still the "strongest" given that they still have non-zero interest rates and most of the world's debts are denominated in USD, which they can print anytime.

On Jakarta, I actually think that it is a nice city. I think every city has its pretty side and its not so pretty side. I won't go to the extent to call it ugly or awful. The reason I said I felt a little uneasy was really due to the COVID-19 virus.

As you might know, Indonesia still has not reported any confirmed case, but we all know it is not possible for such a large country to have 0 cases at this point. Hence, my theory is that the Indonesia government is not being fully transparent here. As a result, most of the people there are not taking the necessary precautions.