Ray Dalio is hinting on this Black Swan scenario, are you prepared?

Ray Dalio is one of my most admired investors. He is the founder of one of the world's largest hedge funds, Bridgewater Associates, and recently he has been hinting on a possible Black Swan scenario which many would never think is possible.

Source

I have personally seen Ray Dalio speak when he visited my ex-employer. This man has a wealth of experience and his words are always backed by research and data. His video on "How the economic machine works" is something everyone should watch. The video sums up key economics concepts that some economics graduates whom I personally know may not even have grasped.

Substantial devaluation of USD

In one of Ray's recent articles, "Paradigm Shifts", he described how the world is in different economic paradigms for the last century. Each paradigm usually last for a decade and now, we are shifting to yet a new paradigm.

Between 2010 till now, as a result of the Great Financial Crisis, the US Federal Reserve was forced to act to bring the world out of recession. The stimulus through the use of quantitative easing (money printing) and keeping interest rate at 0% resulted in a reflationary economy.

Reflation is a fiscal or monetary policy designed to expand output, stimulate spending, and curb the effects of deflation, which usually occurs after a period of economic uncertainty or a recession. The term may also be used to describe the first phase of economic recovery after a period of contraction.

Source

According to Ray Dalio, such stimuli will no longer be effective. He said,

That form of easing is approaching its limits because interest rates can’t be lowered much more and quantitative easing is having diminishing effects on the economy and the markets as the money that is being pumped in is increasingly being stuck in the hands of investors who buy other investments with it, which drives up asset prices and drives down their future nominal and real returns and their returns relative to cash (i.e., their risk premiums)

Essentially, these stimuli only raised asset prices at the expense of future returns. The amount of credit pumped into the financial market had raised asset prices significantly therefore driving down their expected returns. This can be clearly seen from fixed income assets like US treasury bonds (chart below shows the 10y treasury bond yield) which had hit historical lows.

Source

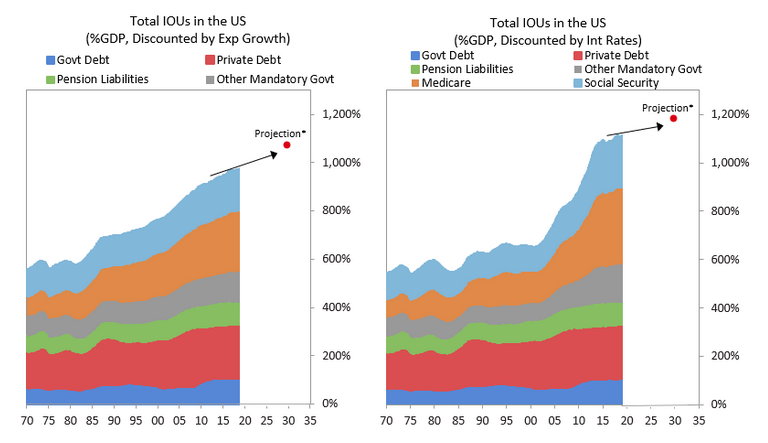

However, the projected expenses required to fund future maturing liabilities are rising. In other words, the income from current assets will unlikely be sufficient to pay off future liabilities in real-terms. Below are a couple of charts showing obligation of future liabilities in the US.

Source

Fortunately, or unfortunately, these liabilities are largely denominated in USD. Hence, the easy solution is to print more money to fulfill these liabilities. The downside is the devaluation of USD. Of course, as we stand, it is unlikely that such devaluation will happen overnight in a form of hyper-inflation. But, it is possible that this will be a slow death when more USD need to be injected and inevitably reducing its value.

In an even more recent article, Ray Dalio reinforced his stand and said,

... large government deficits exist and will almost certainly increase substantially, which will require huge amounts of more debt to be sold by governments—amounts that cannot naturally be absorbed without driving up interest rates at a time when an interest rate rise would be devastating for markets and economies because the world is so leveraged long. Where will the money come from to buy these bonds and fund these deficits? It will almost certainly come from central banks, which will buy the debt that is produced with freshly printed money.

How to prepare for this Black Swan scenario?

The USD is the world's reserve currency. It's devaluation means devaluation to all other currencies that are based on it. Basically, there is no escape if you just switch USD to another fiat currency which is based on it. Hence, Ray Dalio recommends to hold some gold in your portfolio to hedge against such risk. He said,

I think these are unlikely to be good real returning investments [referring to stocks and other equity-like investments] and that those that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold.

My opinion, on top of gold, we should be holding some cryptocurrencies such as Bitcoin, Ethereum or even STEEM to hedge against such risks. If you are not even allocating a small part of your money to cryptocurrencies, then you are doing yourself a huge disfavor when the sh*t hits the fan.

Again, disclaimer that I am not a financial advisor and please do your own due research/due diligence when it comes to investment. Ultimately, you should be taking charge of your own money :)

10% of post rewards goes to @ph-fund and 5% goes to @leo.voter to support these amazing projects.

The "Raise to 50" Initiative

Under 50 SP and finding it hard to do much on this platform? I might just be able to raise your SP to 50. Check this post to find out more!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

I have watched this video few times and it is one of the best explanations about economy so far.

Thanks for a reminder, I guess I'll watch it once again 😁

Thanks for the comment! Haha.. I watch the video at least 3 times as well :)

Thanks for sharing. Dalio is one of the smartest people alive today. I put him right there next to Buffett. I was recently reading Principles which is just full of gems.

Thanks for the comment! Indeed, I have read the Principles as well. It's really a good read :)

Sure, you're welcome.

It is indeed.

And I must confess that I'm envious that you've seen him speak live. :)

@culgin, thank you for supporting @steemitboard as a witness.

Click on the badge to view your Board of Honor.

Once again, thanks for your support!

Do not miss the last post from @steemitboard:

Resteemed and upvoted already @culgin

Thanks! Much appreciated!

@culgin, No matter if Financial Crisis or Depression is ahead, the most important point is, it's not about the fearing it's about the Preparation and taking wise decisions. In my opinion we all know that paper money is nothing but deception and it's not controlled by us, that means it can be influenced very easily.

Gold is just not hold Monetary Value, it's the sign of Natural Power and Divine aspect. And Cryptocurrency is becoming next big thing and in my opinion holding them will give us Financial Control.

Have a great time ahead and stay blessed.

Posted using Partiko Android

Well said!

Thank you.

Posted using Partiko Android

Thank you for your tipu

Posted using Partiko Android

You are welcome! I do not know Korean but the pictures look good! :)