Chart Of The Day: Are Precious Metals Breaking Loose?

I know, you, Steemian guys used to have more cryptos than precious metals but these shiny things now make a really hot summer on investment sites. It can be the hit of the year.

Silver reborn

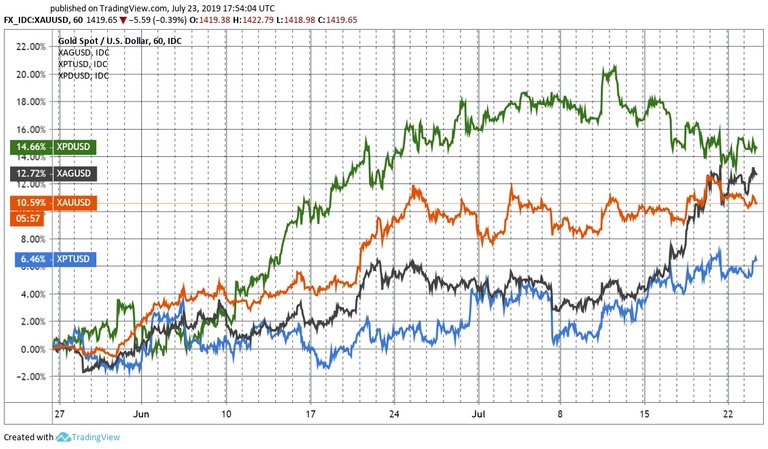

“Silver instead of gold” – sell your gold mine shares, and buy some silver mines – I told myself the 3 of July 2019, and I also wrote it. I was daaaaaaamn almost right. In the last 20 days, gold was 0.4 percent down and silver was reborn, jumping 7.5 percent.

(Click to view in higher resolution. Chart courtesy of Tradingview)

The turn in silver I expected is here but the miners are behaving sluggishly. The GDX gold miners ETF is better, 8.8 percent higher since July 3, but the SIL silver miners ETF, despite the sharp rise of silver, only 9.3 percent. OK, also very nice in a so short time. But mines used to climb 2-3 times more than the same metals, so, in reality, they are lagging behind the usual pace.

Short term or long term?

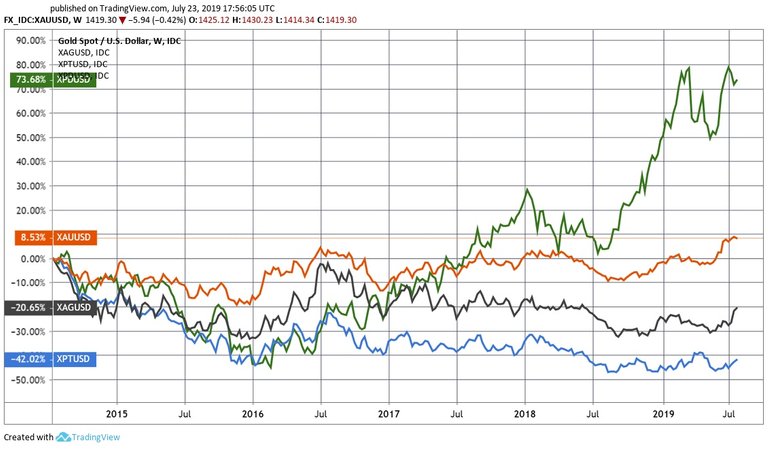

Many investors and analysts are asking: Is this a short rally, or the beginning of a nice, long precious metal bull market? I vote for a long term surge. From the four important precious metals, palladium is rallying for years now and moves near all-time highs. Gold also stays near 6-years high, approximately. Silver, even with this jump, seems to be still very undervalued, only near its one-year top.

(Click to view in higher resolution. Chart courtesy of Tradingview)

This time, platinum seems to be dropped out from rally, staying a lot behind. I would buy it, but I made it already approximately two months ago… See here

My bottom line

I, myself, am a fool. I sold my gold mines and didn’t buy silver mines at the right time. First, I had no time to act. Then, I couldn’t find the right ETF or certificate to do so. I haven’t enough capital to mix my own silver mines shares basket, and the SIL ETF can’t be bought in my country.

I stayed without mines, so later I decided to buy only silver (with some leverage), but relatively late, by 16.41 USD (last Friday). Almost no profit at the time of writing. (I’m sad but patient, I usually invest for months. I have good ideas but I must improve my acting speed and efficiency.)

The series

I started a series with the title “Chart Of The Day” because I see every day interesting things on the markets or in the news. Other parts here:

- Wow, Wow, How Overperforming!

- Is Voice A Success?

- We Need 14,403 Steem Blockchains More!

- How Unstable Stablecoins Can Be?

- Where Is The Chinese Miracle?

- Dominance On 2017-Level

- Are Facebook Shareholders Ignoring Libra?

- Forbid USD, It Is Used For Drug Buying!

- What Was The Biggest Fall Today?

- Is The Steem Inflation The Real Cause…?

- High Traffic Gives A Glimmer Of Hope

I'm extremely bullish on silver. Keep stacking.

Silver is going nowhere. Look at the banks they are piling on short positions. They never loose. Its going nowhere.

Maybe you are right, I'm not so comfortable with silver by 16.50 as by 14.50. I pretend to buy assets on 10-20 years lows and now I made an exception.

But banks are also often wrong. Deutsche Bank reported a quarterly loss of more than 3 billions today... They are eliminating all their investment banking branch now.

Deutsche Bank is an atomic bomb, if that goes under i believe it could take everything down with it. The precious metals action is just a suckers rally to pull in speculators and rinse them. Every couple of years its like clockwork. Silver will go nowhere in the medium term. They have flashed a couple of warning signs though in the last year in that they were net long about 3 times for a week or two. Its going to go one day but its not now. Short positions are climbing with every rise.

Deutsche should be too big to fail, but share holders would be diluted out from it in case of a crisis.

We are in an everything-bubble, stocks on top, bonds on top... Why not a nice commodity bull market as next hype?

It could be, i just dont think it will happen yet. Maybe im wrong we will see. :)

Congratulations @deathcross!

Your post was mentioned in the Steem Hit Parade in the following category:

You got a 97.41% upvote from @brupvoter courtesy of @deathcross!