Stock Market Oil Story Continuation (04.21.20)

Today's trading will be one for the record books. Current May /CL contracts which is crude oil was trading as low as -$39 on the day before expiration. That meant holders of the contracts were selling it out to buyers for a loss. Basically contract holders were paying buyers to hold the contracts. Main reason prices are dislocated is recipients of these contracts when they are executed have no place or have the expense to store the oil. So 1 barrel of oil for -$39. Just wow.

The issue with storage is mainly two parts. First the global slow down due to the virus pandemic has made demand dry. On top of all that Saudia and Russia are having a fit in OPEC to see who would come out strongest by both pumping oil to lower prices, aka price war on oil. It does not help many countries including the USA needing to produce oil in order for oil producers to avoid from becoming insolvent.

The pain for USA is that being the #1 producer of oil in the world and having oil prices drop and demand drop has lead to many oil companies struggling to make a profit. In turn these companies are unable to pay down its debt and likely default and go bankrupt. The only way out currently is for the oil companies to produce even more oil to sell to break even and stop production in wells that cost more than to dig the oil out. All in all the energy sector is becoming a downward spiral of massive losses not only in the USA but also around the globe.

Yet today the market in general held up well considering it was only down slightly less than 2% while still up over 30% from it's yearly low. Another strange part to this is many oil companies stocks actually were slightly red to flat close when oil prices were free falling.

Oil Concerns Ahead

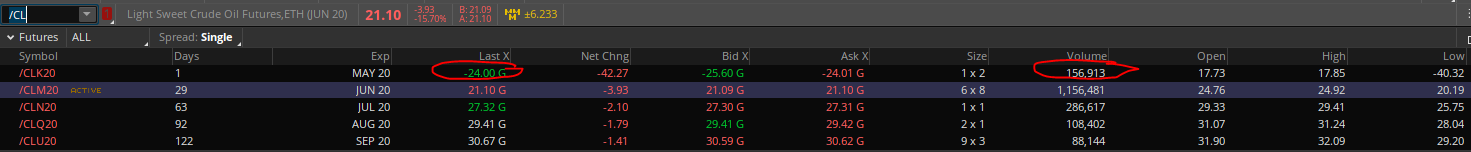

There is more caution to take on oil even though May contracts will expire tomorrow hence the negative prices will be gone by Wednesday. What will be in place will by the June contracts which current prices is hovering above $21. The concern though is although May contracts was having devastating results due to oil head winds, the June contracts are currently six times as large as May. Picture below one can see 156k of May contracts being traded versus over 1.1mil of June contracts. If in the next four weeks the current conditions of the pandemic is still the same as today it will be another devastating drop for oil. However all signs currently point to a better outcome for June versus May. As we enter the month of May it should be carefully watched as to how much demand is there for oil. This will lead toward some effect on the overall market.

He said, 'Stop doing wrong things and turn back to God! The kingdom of heaven is almost here.'(Matthew 3:2)

Question from the Bible, Is there a need for baptism?

Watch the Video below to know the Answer...

(Sorry for sending this comment. We are not looking for our self profit, our intentions is to preach the words of God in any means possible.)

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #HivePower, It's our little way to Thank you, our beloved friend.

Check our Discord Chat

Join our Official Community: https://peakd.com/c/hive-182074/created

June will go below $10 at some point. My prediction

Just a unbelievably historic day..... IMO the opposite is going to happen when people want to convert their paper silver to the real deal!!