The Ability To Diminish Power

Steem, along with other blockchains, is in a very interesting position. Never before have we see so much power given as we are seeing with the push towards decentralization.

While this will not be an overnight process, nor will it likely ever be complete since some business models do work better under centralization, we are seeing a move towards the breakdown of the present financial system.

Of course, presently, we are seeing the same tactics used as in the past. Regulators and lawmakers are running around trying to legislate behavior. They are operating as if entities/individuals have no choice.

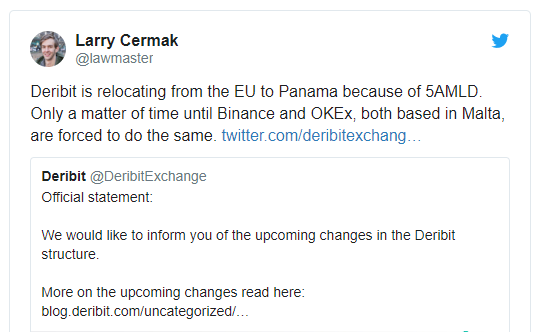

Yesterday, it was announced that the cryptocurrency derivative exchange, Debrit, is leaving the EU and relocating to Panama. The reason for this is the anticipated Anti-Money Laundering Directive 5 (AMLD5).

While few will turn their heads at the name Debrit, there are others that are also in this same predicament.

https://coingape.com/debrit-exists-eu/

The big name on here, of course, is Binance. This is one of the better known entities in the crypto space and, one of the most successful.

In this age, where entities are basically online, the ability to up and move to another physical areas is really nothing more than a paperwork change. If there are corporate offices, perhaps they have to be relocated yet they are usually run with small crews since developers tend to be from all over the world.

Either way, this is a sign of how the mobility of these types of companies is going to make it hard for countries to protect the existing system. If they do, they might lose a lot of tax revenue as the companies move out in search of more friendly environments.

The derivatives market has long been controlled by Wall Street. Naturally, this means it comes under the watchful eye of the SEC. What is very interesting is the fact that this market is mostly unregulated. In other words, the institutions on Wall Street are free to do as they wish.

What makes this a real eye opener is the fact that the derivatives market, by some estimates, is as high as $1.25 quadrillion. In comparison, the United States stock market is estimated to be worth roughly $30 trillion dollars, or a fraction of what is out there in derivatives.

To take this to another level, Wall Street has the power to create whatever they want out of thin air while it is illegal for everyone else. Keep in mind that derivatives, for the most part, are not asset backed. They are just agreements or financial instruments that derive their value based upon something else. This really gets interesting when one delves into synthetic derivatives which are basically tied to nothing.

Isn't it ironic that the Wall Street crowd accuses cryptocurrency of having no inherent value?

Decentralized platforms put things on a different level. They offer the ability to rip down the existing power structure. In this instance, Wall Street's hold on derivatives is being broken.

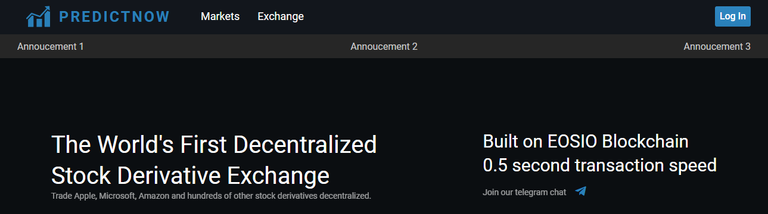

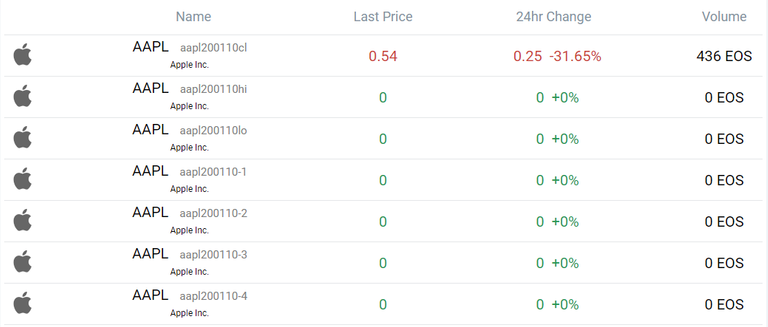

Take a look at this project that is in testing and about to be released on EOS.

They are going to create stock derivatives that can be purchased using cryptocurrency.

All this drives home the point of value. What is it that has value? Anyone who looked at this question through the lens of cryptocurrency knows that value is whatever we ascribe it to. Markets have a way of establishing price discovery based upon whatever it desires. It is rarely logical or based upon fundamentals.

Many will claim that the derivatives market is based solely on speculation. I would agree with that. However, we see the same thing in the stock market. Tesla, right now, is valued, according to the market, at more than GM and Ford combined. Is this accurate? Does it really matter? For the moment, that is what the market decided.

Liquidity tends to be a more important component in markets than "inherent" value. Anyone who played with penny stocks knows that some have such huge spreads that the value is all over the place. We see the same thing with some Steem-Engine tokens that do not have much activity. Without the liquidity, it is going to be difficult to have a realistic price discovery.

What does this all mean?

Everyone, naturally, has to access his or her own risk. I am not making the claim that any of these products are for everyone. The point here is that we are seeing platforms established that are going to allow people to enter into these realms without using fiat. What was under the control of Wall Street is now out there on decentralized platforms.

We are also seeing more outlets for people to put their cryptocurrency to work and get a return.

A blockchain like Steem is providing people with options. As we see more platforms built on top of it, the offerings that are available are only going to increase. I hypothesize that we are going to see applications such as I mentioned here on most blockchains. As we see ecosystems forming, people are going to provide avenues for the tokens earned on that particular blockchain.

I do believe in the power of numbers. While we see only a handful of projects like this one, what happens when there are hundreds of them out there? What are countries going to do when there are dozens of Panamas willing to attract blockchain businesses with very friendly regulations? How are they going to handle the emergence of tens of thousands of DAOs?

We are in an interesting time. Just like every blog that was set up cut into the traditional information purveryors, i.e. the newspapers, we are now seeing the same thing duplicated in a number of different industries.

Blockchain handed developers the basis to decentralize their creations. This is going to radically alter power structures all over the world. Ultimately, I see many of the having their power diminished as more people opt out of their present way of doing things.

Steem and other platforms like it are laying the foundation for that day to arrive.

If you found this article informative, please give an upvote and resteem.

According to the Bible, What does the Bible say about changing religions? (Part 2 of 2)

Comment what you understand of our Youtube Video to receive our full votes. We have 30,000 #SteemPower. It's our little way to Thank you, our beloved friend.

Check our Discord Chat

Join our Official Community: https://beta.steemit.com/trending/hive-182074

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

The Predictnow project seems to have no action there.

Hi @taskmaster4450!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 6.138 which ranks you at #275 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 92 contributions, your post is ranked at #2. Congratulations!

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server