The US stock market continue its run

The US stock market has once again reached all-time-high. A couple of months back, I wrote this post on why I think the stock market can still run on and that turned out to be true, at least for now.

Source

If the market moves according to what I anticipate, then it will likely go through the following phases,

- Retail investors forget about the dangers lurking

- "Positive" events start to "occur"

- Stock market continues to make new highs

- Mainstream media shifting from negative to positive sentiments

- Market euphoria seeps in

- Black swan event occurs

- Market crashes badly

So how far are we into these 7 phases?

Retail investors forget about the dangers lurking

Retail investors are a forgetful bunch of people. My theory is that most of us are too caught up in our work and cannot be bothered by past events/news. Hence, we tend to forget what was reported yesterday and only be led by what is reported today.

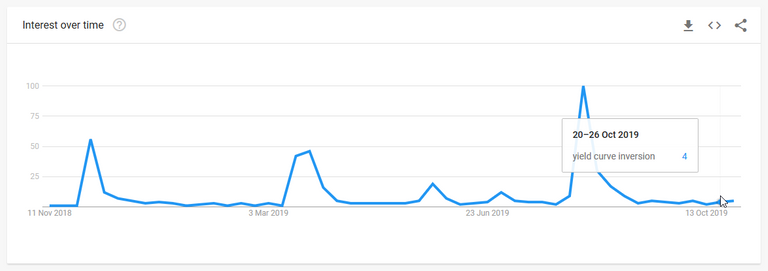

In August this year, yield curve inversion and recession were the hottest topics in town. In my previous article, I showed the Google search trends for "yield curve inversion" and "recession" where both of them had hit one year high in terms of Google search activities. Since then, the search activities for these bearish terms have fallen drastically as shown in the charts below.

This goes to show that the retail investors have already forgotten about the possible recession that the yield curve inversion typically predicts. Phase 1 completed!

"Positive" events start to "occur"

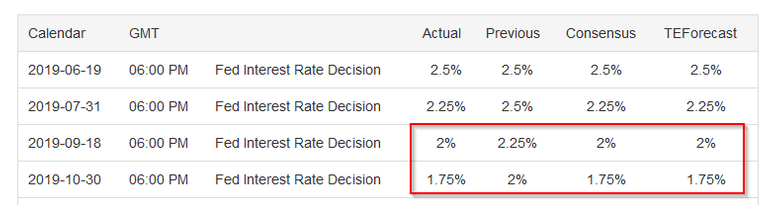

In the article, I mentioned that the Federal Reserves rates were standing at 2.25% and there is still room for cuts. On top of that, I also talked about how US President Donald Trump is using the trade war as a way to manipulate the Fedd into lowering interest rates. True enough, the Feds had lowered rates twice since the post.

Source

At the same time, there seem to be some kind of progress between US and China in terms of the trade war. These are all "positive" events that are occurring right now. Phase 2 done.

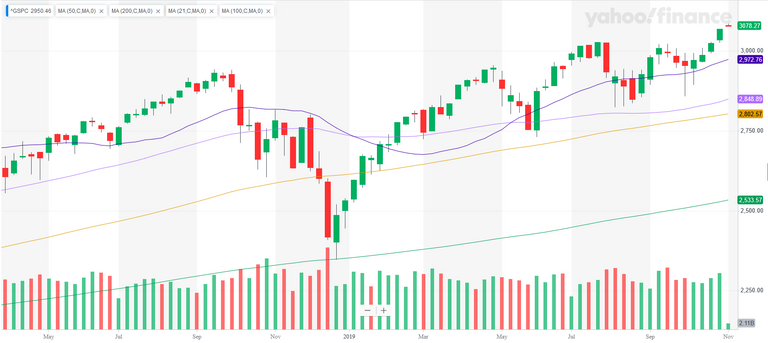

Stock market continues to make new highs

Yesterday, the S&P 500 index closed at 3078, reaching all-time-high. As some said, the trend is your friend until it ends and the trend right now seems to be upwards.

Without a reversal signal, this trend will likely continue and my personal targets are 3080, 3170 and 3290. These were the targets I made backed in July.

Along the way, there is bound to be ups and downs, but as long as higher lows and higher highs are made each cycle, the trend remains intact.

It is important to note that phase 3 is only completed when there are multiple times higher highs and higher lows are set. Hence, we are not there yet and we shall see how it goes.

Mainstream media shifting from negative to positive sentiments

In the same article, I also mentioned this,

... my hunch is telling me the smart money are accumulating since January 2019 all the way till last month [August 2019]. The last month dip was just created for the smart money to accumulate further. Potentially, this might be the final stage of smart money accumulation. The next phase will be for mainstream media to start focusing on some positive news and slowly let the FOMO seeps in. When the FOMO is at the highest, that is when the smart money will sell.

Here are some of today's headlines on Yahoo Finance.

Clearly, the sentiments are still quite negative right? However, why is the market still going up? So here is where I have to remind you of this quote,

"Don’t listen to what people say, watch what they do"

Despite the mainstream media's warning signals, the market is still going up. That to me is again a misalignment of actions and words. In phase 4, the mainstream media have to change their tune and project an overall bullish sentiment.

I think phase 4 will only start when phase 3 has completed. For now, we can only continue to listen to the tune the mainstream media sing and plan our next move.

Conclusion

I still think stocks are still very much overvalued and I stand by the analysis I made last year. If the market does move according to the 7 phases I anticipates, then we are already starting the 3rd phase. There will still be some juice to squeeze out from the market but it will be increasingly risky. Personally, I am extra cautious on the stocks I pick and will start to take partial profits really soon.

By the way, this is not a financial advice and I am not a qualified financial advisor so please take this article with a pinch of salt. DYOR and DYODD.

The "Raise to 50" Initiative

Under 50 SP and finding it hard to do much on this platform? I might just be able to raise your SP to 50. Check this post to find out more!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

One of my close friends was just telling me how he knows a guy that is switching everything he has to cash for this exact reason. Great post :)

Posted using Partiko Android

Might be too early but its certainly a wise choice in the longer term. Will be even better to have a little in crypto though :)

Great article, I do believe the Markets are going higher, but agree, the retail investors needs to be careful.

Indeed, the narrative seems to be pointing to that. We shall see. Thanks for the comment!

The stocks are rising because of pumping new money to the system. This will continue at least to the election in US next year, then we will see. It will be already after bitcoin halvening, so... :-)

Agree that the run might stretch till the upcoming election. It's always a wise idea to own some Bitcoin :)

Sure, some money will flow to bitcoin I guess also and then if there will not be anyone willing to sell....

Hi @culgin

Resteemed already. Upvote on the way :) (need to wait till voting power will fully reacharge)

Thanks!

Thanks for the post.

It is interesting to study the cycle of occurrence of events that seem to follow a cyclical pattern.

Indeed. Thanks for reading!

@culgin, In my opinion we are surrounded by lot of Information and from long time till recent days we were hearing about the Global Market and Economic Crash but it didn't turned out in that way.

In my opinion we are seeing Manipulation more than reality.

Enjoy your time ahead and stay blessed.

Posted using Partiko Android

Yup, that's why I think the run can still go on for a bit more. Have to continue monitoring the mainstream media's narrative though

Mainstream plays vital role in both cases, by that i mean and in my opinion we can see Manipulation and Reality at the same time. Stay blessed.

Posted using Partiko Android